Payoneer is a reliable financial services company based in New York, offering fast online money transfers and secure digital payments. If you are looking for an alternative to PayPal, Payoneer is an excellent choice due to its lower fees and enhanced security features. Here’s a step-by-step guide on how to open a Payoneer account

Step 1: Begin the registration process

To get started, visit the Payoneer website and click on the “Sign up” button to initiate the account creation process.

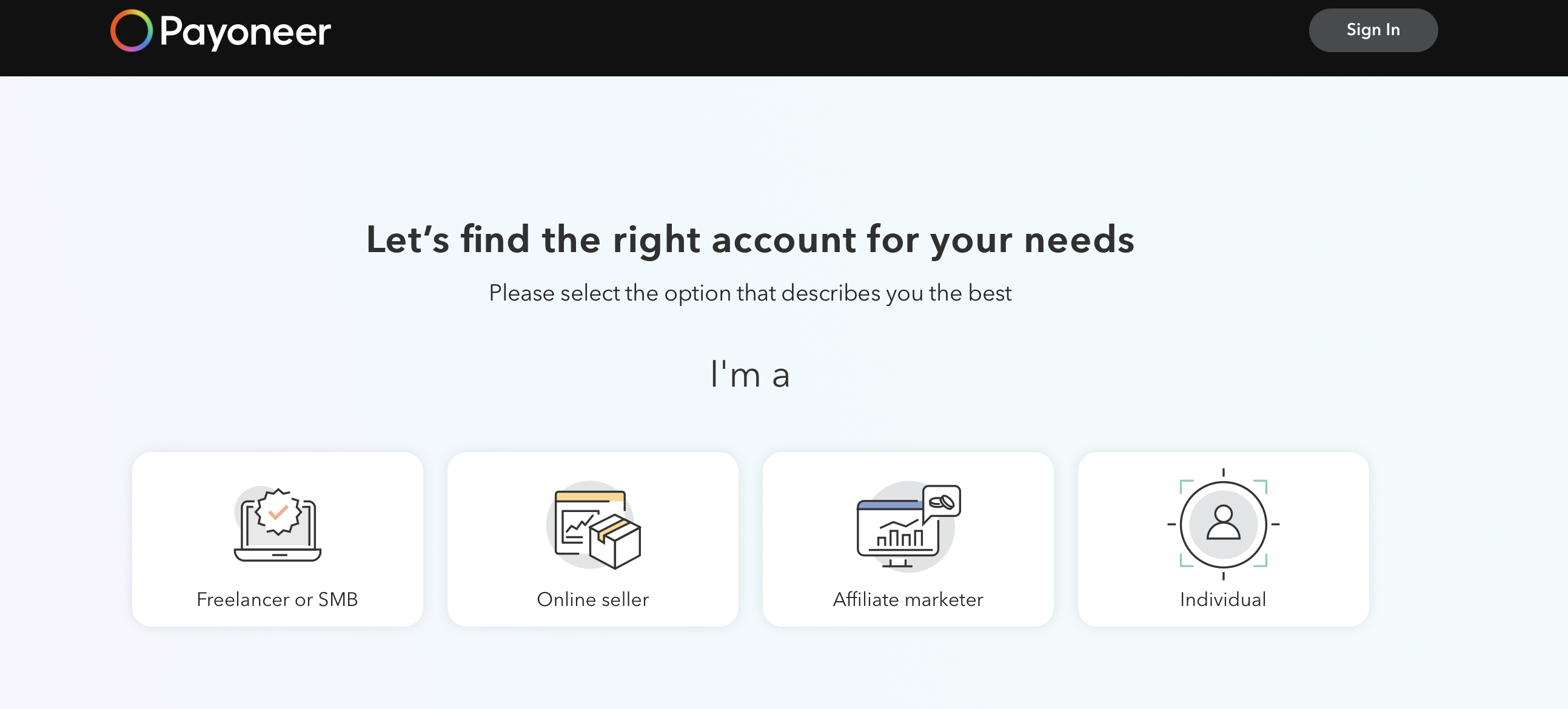

Step 2: Select your account type

After clicking the sign-up button, you will be asked to choose the type of account that best suits your needs. Payoneer provides options for freelancers, small and medium-sized businesses, online sellers, affiliate marketers, and individuals.

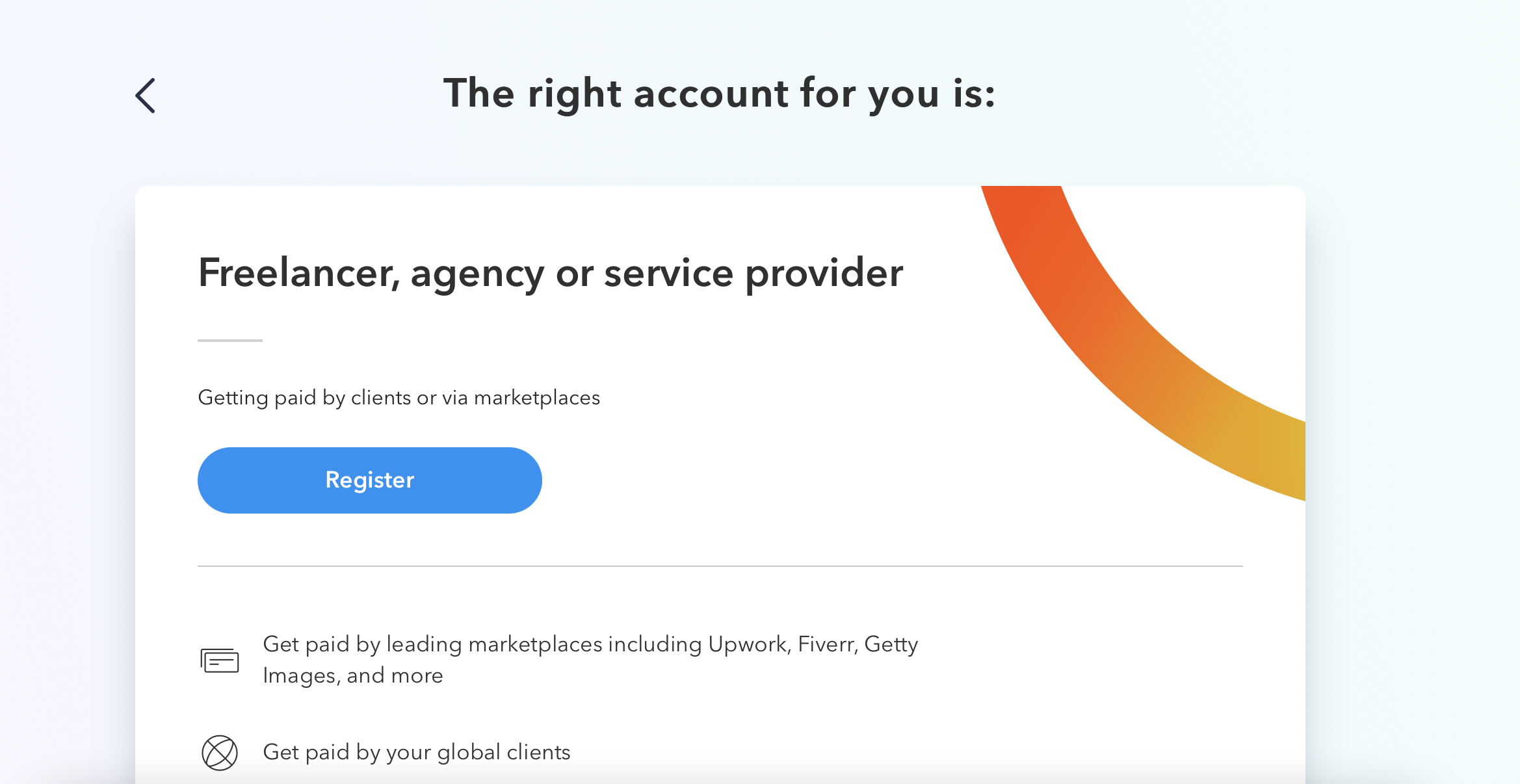

Step 3: Specify the purpose of your account

Next, you need to determine the purpose of opening a Payoneer account. Depending on your selection in the previous step, you can choose between options like receiving international payments, transferring money between friends and family, or ordering a prepaid card.

Step 4: Complete the registration

Once you’ve selected the appropriate account type and purpose, Payoneer will recommend the best account option for your requirements. Click on the “Register” button to proceed with the registration process.

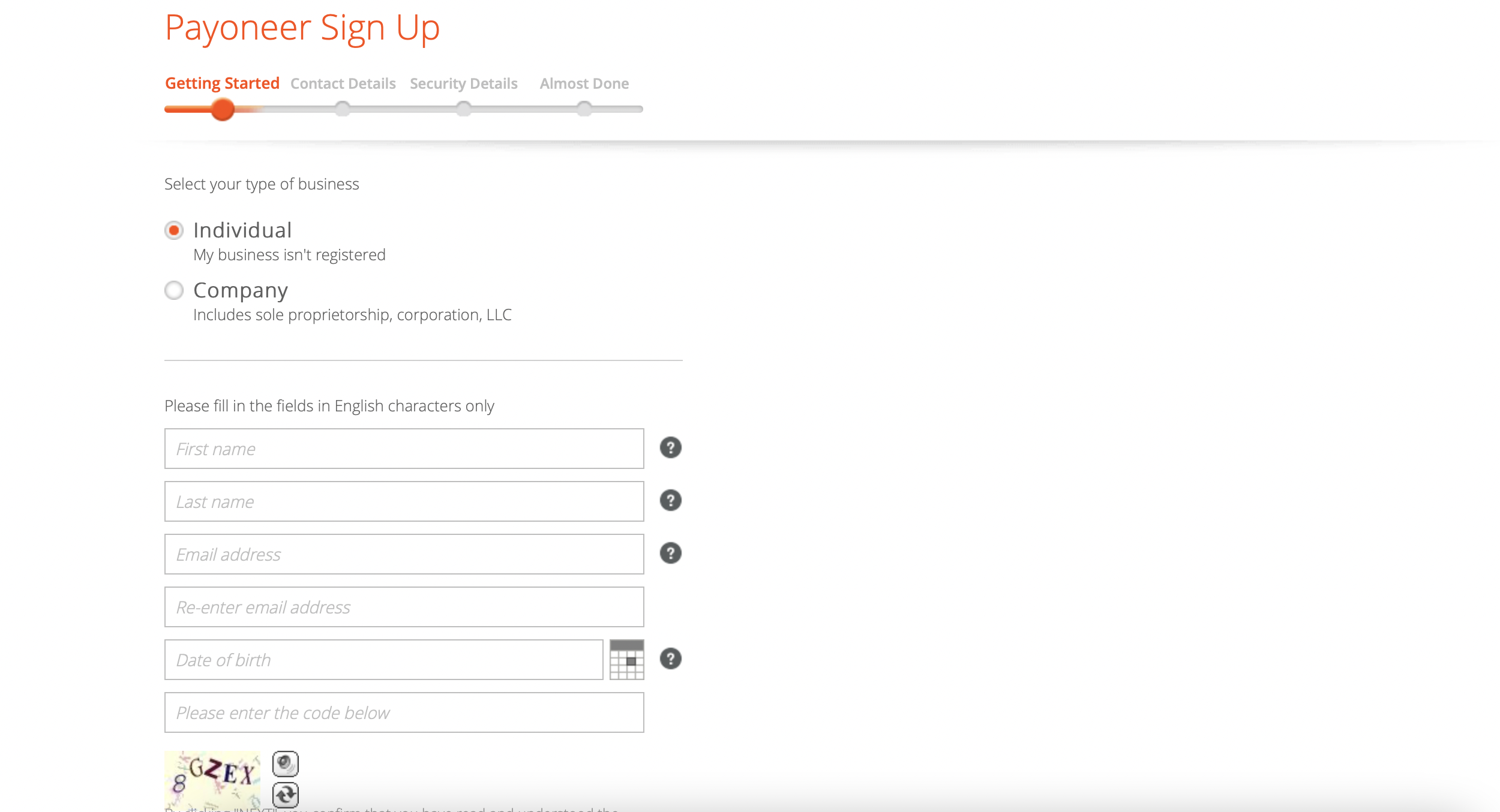

Step 5: The registration process – four steps

The registration process consists of four steps:

a) Getting Started: Provide essential details, such as your full name, email address, date of birth, and business type (individual or company).

b) Contact Details: Enter your country, city, address, and phone number. You will receive a verification code on the provided phone number.

c) Security Details: Set up a strong password, security question, and answer, and enter your passport details for additional security.

d) Almost Done: Choose between a personal or business bank account for withdrawal, provide your bank account details, and submit your application.

Step 6: Verification and necessary documents

Once your application is submitted, Payoneer will review it. During this process, they may request additional documents for verification. To check the status and submit necessary documents, log in to your Payoneer account and go to “Settings” > “Verification Center.” Ensure that the required documents are valid, not expired, and of good quality.

Upload the documents in supported formats and make sure they do not exceed 3 MB in size. Submit each document separately if multiple are required. After submitting, wait for Payoneer’s approval, which will be confirmed via email within a few business days.

Certainly! Let’s continue with some additional information about the benefits of using a Payoneer account and how it can enhance your financial transactions.

Advantages of using a Payoneer account

1. Global Payments Made Easy: With a Payoneer account, you can send and receive payments from clients, marketplaces, and businesses all over the world. Say goodbye to the hassle of dealing with multiple payment methods or currency conversions.

2. Low Transaction Fees: Payoneer offers competitive transaction fees, making it a cost-effective solution for freelancers, small businesses, and individuals. You can keep more of your hard-earned money without worrying about excessive charges eating into your earnings.

3. Enhanced Security: Payoneer places a strong emphasis on security measures, protecting your financial data and personal information. Their advanced encryption protocols and fraud detection systems ensure that your transactions are safe and secure.

4. Convenient Withdrawals: The Payoneer MasterCard allows you to withdraw funds from ATMs globally, providing easy access to your earnings. Additionally, you can link your Payoneer account to your local bank account for seamless withdrawals at low rates.

5. Integration with Major Marketplaces: Payoneer is widely accepted by popular international marketplaces such as Upwork, Fiverr, Getty Images, Amazon, and more. It means you can receive payments directly from these platforms and avoid unnecessary delays.

6. 24/7 Customer Support: Payoneer offers round-the-clock customer support, ensuring that any issues or queries you may have are promptly addressed. Their support team is dedicated to providing assistance and resolving problems in a timely manner.

7. Fast Payment Processing: Unlike traditional bank transfers, which can take several days to complete, Payoneer ensures swift payment processing. This is particularly beneficial for freelancers and businesses that rely on timely payments.

Getting the most out of your Payoneer account

Once your Payoneer account is approved and set up, make the most of its features to optimize your financial transactions:

1. Explore Partnerships: Payoneer collaborates with various companies, offering exclusive benefits and rewards to its users. Keep an eye out for such partnerships to take advantage of discounts, promotions, and cashback offers.

2. Monitor Transactions: Regularly review your transaction history to keep track of incoming and outgoing payments. This will help you maintain accurate financial records and identify any discrepancies.

3. Utilize Payment Requests: If you are a freelancer or service provider, use Payoneer’s payment request feature to send professional invoices to clients. This ensures a seamless and professional payment process.

4. Set Payment Reminders: To avoid late payments or penalties, consider setting payment reminders for bills or subscription services linked to your Payoneer account.

By utilizing these tips and making the most of your Payoneer account, you can streamline your financial activities and enjoy the benefits of efficient global transactions. With the increasing demand for remote work and cross-border business, Payoneer proves to be an invaluable tool for managing your finances effectively. Happy banking with Payoneer!

Summing up thoughts

By following these steps and providing the necessary documents, you can successfully open a Payoneer account. Enjoy secure online transactions, global payments, and the convenience of a Payoneer MasterCard for accessing your funds at ATMs worldwide. For any future updates and insights, stay connected with Amaz.Markets!

0