International payments are often one of the main issues startups and large companies face. This is especially relevant for countries where payment services such as Stripe and PayPal are not common. What’s more, Stripe is a great platform that allows companies to accept online payments in different currencies. Let’s see how to sign up for Stripe.

Why is it important to have an international wallet?

Payments issues can easily kill all enthusiasm among entrepreneurs and ruin even the most ingenious business idea. The lack of an easy way to withdraw funds and accept payments forces business owners to move their businesses to other countries.

Whether I can integrate Stripe into my website?

Stripe handles everything between the customer providing their card information and confirming that their payment has been received and therefore accepted. In addition, Stripe has simplified the service process for business owners.

From a developer’s perspective, Stripe removes all the tedious and hard work of processing payment systems by providing a robust payment infrastructure through a single, developer-friendly API.

Stripe – will be your best assistant in accepting payments if you’re developing a website or mobile app, with a catalog of your services/goods.

You can integrate the Stripe API into your payment acceptance website to handle major international debit and credit cards; including Visa, Mastercard, American Express, Discover, Diners Club, and JCB. It’s easy to integrate and comes with a variety of integrations libraries or documentation.

What’s more, the API sets clear expectations about what’s possible and how to achieve it. So instead of learning complex rules about banking, accounting, and payment card industry (PCI) compliance, developers only do what they do best: code.

Should your company use Stripe?

Without a payment gateway, your company will need a huge technological stack and a separate payment system.

If your company makes online transactions (via credit or debit cards and mobile wallets), it’s still better to choose Stripe, since it’s becoming the backbone of online business today.

Some of the world’s largest companies, such as Amazon or Shopify, have chosen Stripe as their trusted payment gateway. Because Stripe has amazing security and availability of the best development tools. Whether you’re an online store, a B2B platform, or a B2C marketplace, Stripe can help you secure your business transactions.

How do I sign up for Stripe? Documents and requirements

The following are Stripe’s requirements for accepting payments from the United States:

- U.S. bank account

- SSN / EIN

- US Mailing Address

- US phone number

Bank account or company registration?

The easiest way is to register an LLC (limited liability company) or C-Corporation in the US and open a bank account there. However, even if you can register an LLC (which is easy enough and can be done remotely), no bank in the US will open an account without the potential owner visiting a bank branch first.

In addition, Stripe will require you to enter your SSN (Social Security Number) or EIN (Employer Identification Number) to verify your identity.

But the good news is that you still have the option of using Stripe without first visiting the United States. You can simply link your Payoneer account information in the bank account field. Here you will find more on how to open a Payoneer account.

SNN/EIN: What does it mean?

As SSN (Social Security Number) is issued by the US Social Security Administration (SSA) only to US citizens, permanent residents, and temporary (working) residents. Foreigners, on the other hand, cannot receive it.

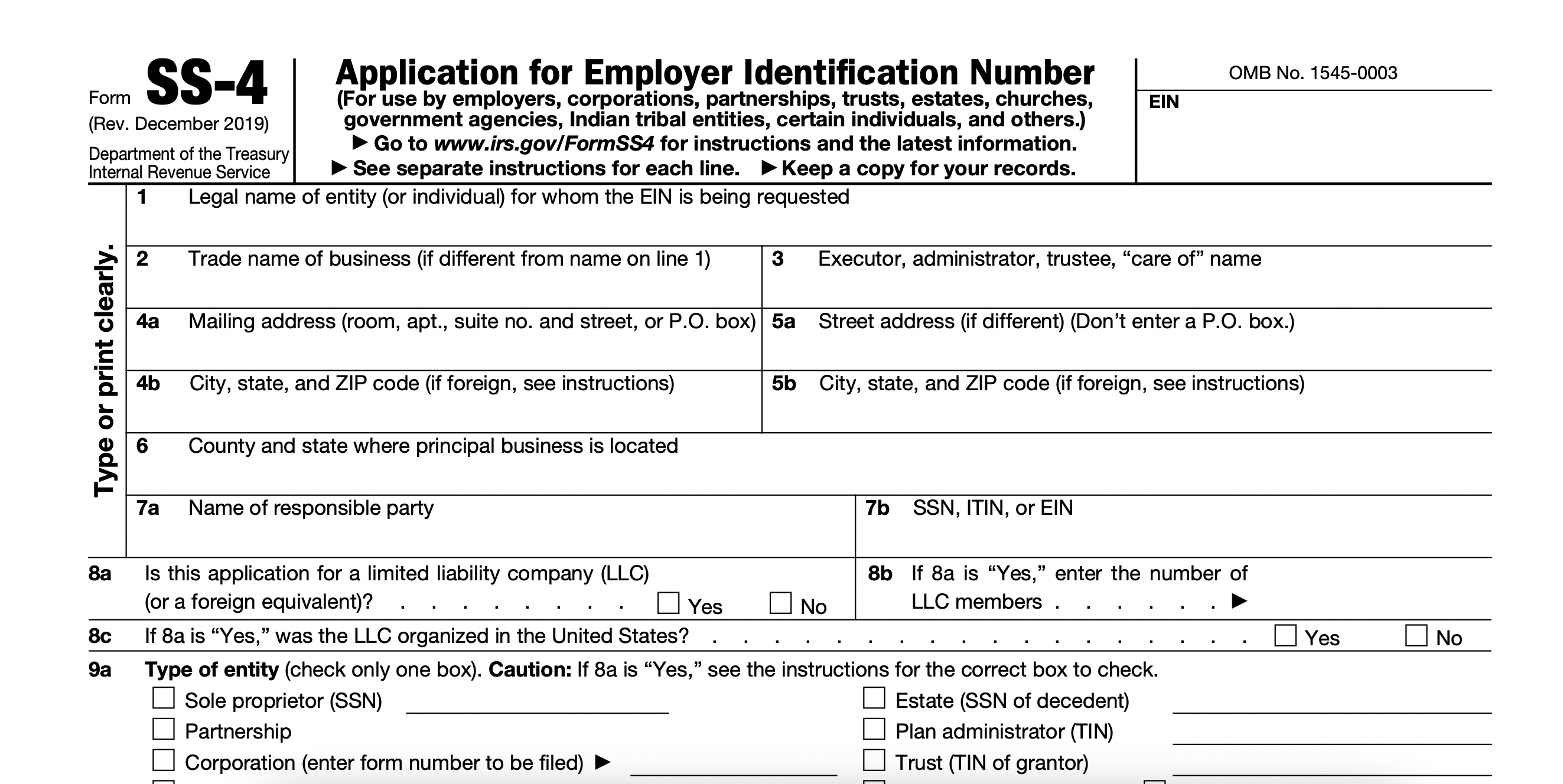

An alternative to SSN is EIN (Employer Identification Number), also known as a Federal Tax Identification Number, which is used to identify a company in the USA. To obtain an EIN remotely, you must call the IRS (Internal Revenue Service) and do the following

- Download this form and fill it out in advance.

- Call the IRS – the phone number is 1-800-829-4933 – and tell them you need an EIN. They will insist on faxing the form, but there is a workaround for that. Just tell them you don’t have a fax machine and would like to do it over the phone.

- The operator will ask you to read out the fields on the form.

In 15 minutes at most, you will have an official EIN, which will also be mailed to you at an address in your country.

U.S. Mailing Address

Getting a mailing address in the U.S. is quite easy. To do this, simply sign up for any P.O. Box service. Many online services offer such services, such as MailBox Forwarding.

They provide you with a mailing address that is available online. You will be able to receive and view all your mail: letters, documents, and packages, whether they are delivered by USPS, FedEx, or UPS.

In the future, you may need to receive important documents by mail, such as from the IRS or Stripe.

US phone number

You can get a phone number in the U.S. through various companies that provide these services, such as Sonetel.

Then you need to forward it to your local phone number. This will cost about $2 per month and will allow you to receive all calls directly to your phone number.

Benefits of using Stripe

Stripe is known for its fast and secure payment processing. In addition, because of its ease of integration and ease of use, many business owners and developers find the Stripe platform easy to work with.

Here are a few other significant benefits of using Stripe as your online payment system:

- A fully integrated suite of payment products

Stripe gives you and your developers everything they need to build systems that accept online payments worldwide. That means Stripe offers credit card processing and payment gateway services.

- Powerful and easy-to-use API

Stripe makes the development process more manageable because it has extensive documentation. Written in clear and understandable language, it makes it easy for developers to understand the product and its API. What’s more, there are many ready-made solutions (built-in libraries) as well as opportunities to customize the Stripe payment gateway.

- A technology-driven approach to payments and finance

Stripe optimizes every aspect of the financial stack. As a technology-driven company, Stripe focuses on releasing new features and enhancements every year, helping you stay on top of industry changes.

In addition, Stripe operates with 99.9%+ uptime and is highly scalable, and complies with the highest standards of compliance. Stripe’s goal is to help increase your company’s revenue through smart technology methods.

- Full suite of security features and customization options

Stripe is protected by SSL (Secure Socket Layer) protocol. This means that your financial information (credit card information, bank account number, and passwords) is properly encrypted. In addition, Stripe is also PCI (Payment Card Industry) compliant, so rest assured that your information is secure.

Stripe fees and pricing plans

Like any other online payment platform, Stripe charges a standard fee per transaction. The company charges a flat rate of 2.9% + $0.40 for non-European cards, similar to PayPal and Square.

One positive thing about Stripe’s pricing, however, is that the company gives volume discounts to businesses that make more than $108,000 in sales each month.

Key thoughts: What documents do you need to sign up for Stripe

Let’s recap and go over the paperwork required before registering for STRIPE:

- Account on Payoneer to get a US bank account.

- EIN from IRS using this statement.

- Mailing address from MailBox Forwarding.

- US phone number from Sonetel.

You really can set up your online payment infrastructure in minutes with Stripe services, but before you do, you may want to determine if your company is the one that needs Stripe to process payments. For some small businesses or startups, Stripe can be an expensive option. Although you get several services from Stripe, you may not even use all of them. So consider the benefits that Stripe offers and only then make your decision.

In the next article, we’ll go over a step-by-step guide to registering for Stripe, after you’ve gathered all the necessary documents! Stay tuned.

0