Wise was launched in 2011 to make international money transfers cheaper, fairer and easier. Today, this multi-currency account helps millions of people and businesses manage their money all over the world. But how to create Wise account? Let’s see!

Wise values

First, Wise is an online account that allows you to send money, get paid, and spend money abroad. With a Wise account, you can send money abroad, get paid in other currencies, and spend money abroad with your Wise card.

How Wise works: helping people manage their money internationally more cheaply, quickly, and transparently.

Besides, millions of people and businesses trust the company to transfer their money, saving on bank fees and time. With a Wise account, they keep balances in more than 50 currencies and use a debit card to shop and spend abroad.

The company partners with banks and companies such as Monzo, Bolt, and GoCardless to offer its customers the best international banking services. Incidentally, people like Richard Branson and PayPal co-founder Max Levchin, among others, have already invested in this company.

Wise values are very simple:

- Transfers are cheap.

The real exchange rate is the only fair one – and that’s what you get with Wise. The company shows all fees in advance. Why? Because markups and hidden fees are unfair!

- Transfers are easy.

Sending money doesn’t have to be stressful – no matter how far they travel. The company created the app and website so you can manage your money on the go. They’ve also created a team dedicated to keeping your money safe and the process airtight.

- Transfers are fast.

The company believes that sending money should be as fast as sending an email. It takes a few minutes to create an account, and most Wise transfers are instant or same-day.

And now…let’s see ho to create a Wise account!

How to create a Wise account: a step-by-step guide

The company has two accounts: a business account and a personal account.

Both of these accounts help:

- Receive your paycheck, pension, and more.

- Move without the stress – and multiple bank accounts.

- Spend money in local currency with a card.

- Avoid bank visits and spend it immediately upon arrival.

- Move money between countries.

- Send money to 80 countries, always with low and transparent fees.

Wise account signing up: How to create a Wise account?

Let’s start by registering on Wise!

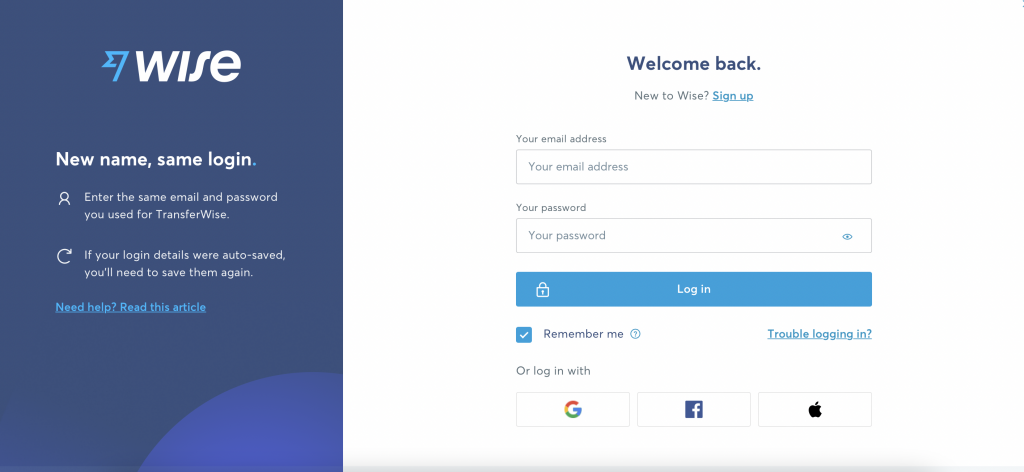

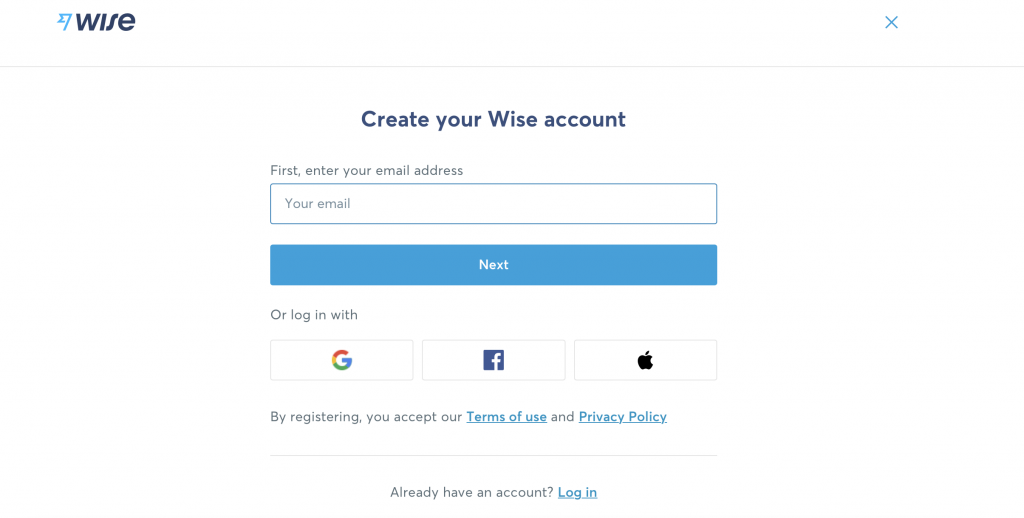

- Registration takes place in a matter of minutes, as you can log in through your Google, Facebook, or Apple account.

- Or just enter your email and click on Next

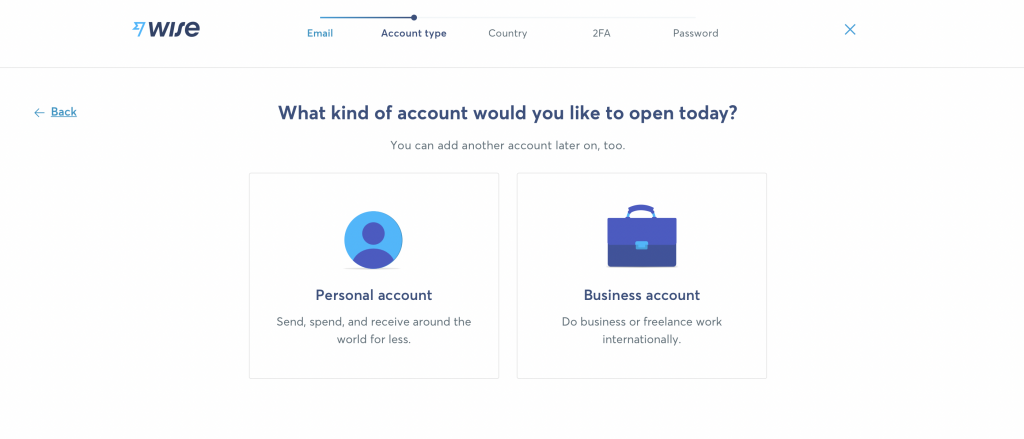

- Then choose the type of account: personal or business

Step-by-step guide: How to create a Wise account

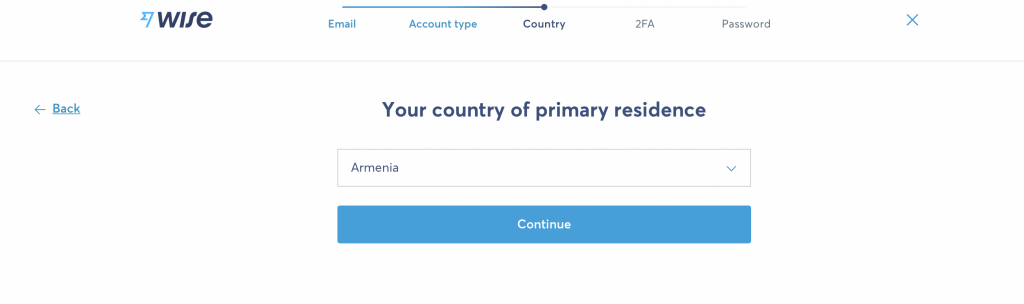

- Choose primary residence country

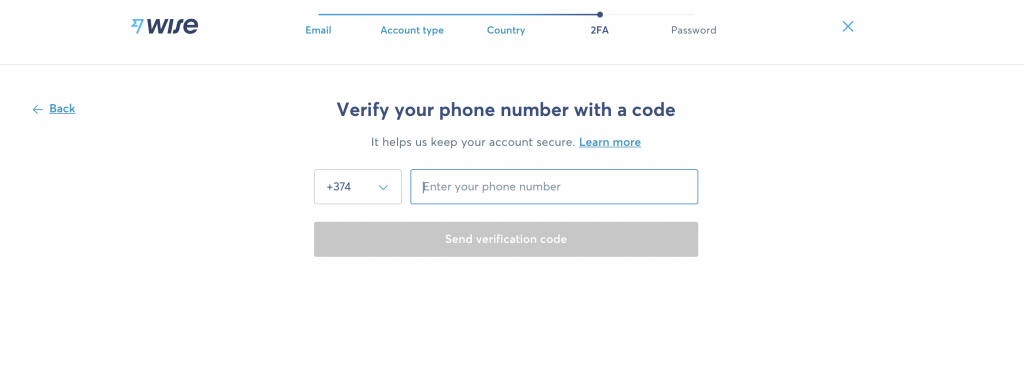

- Enter your mobile phone number and use the code received by SMS

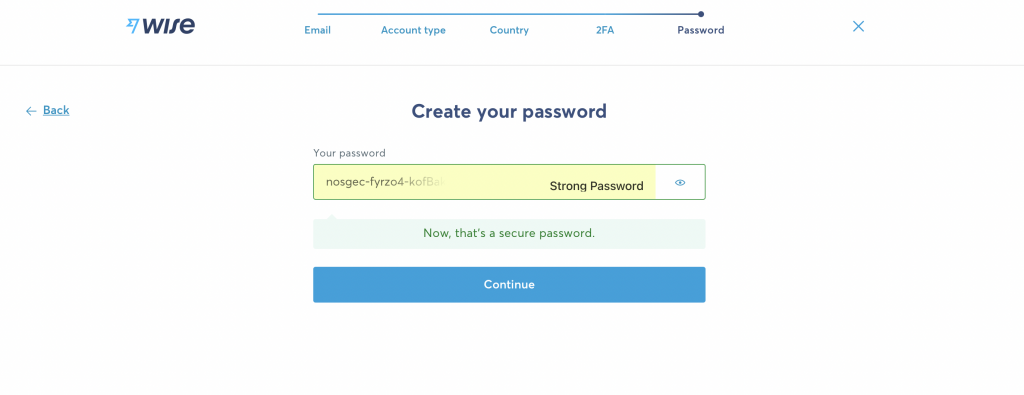

- Chose a password for your account

That’s it!

Now let’s verify your account.

To open an account with Wise, you need to be verified, usually with a photo ID, proof of address, and/or your photo with that ID. This usually takes about 2 business days.

What about those who want to open a business account on Wise?

How do I verify my business account at Wise?

- Register at

- Tell the company about your business. You will need to provide information such as your business registration, location, the industry in which you operate, your online or social media presence, as well as the name, date of birth, country of residence of all concerned, and a document showing who owns or controls the company.

- Tell the company about yourself. As the owner of this account, the company needs your personal information to verify your identity. If you are not a director of the company, you may need additional information to verify that you are authorized to act on behalf of the company.

- Set up and pay for the transfer. If you are setting up account details, you will need to pay a one-time setup fee.

- Now it’s Wise’s turn. Wait for 10 business days.

What kinds of documents does Wise accept?

All information on the document you provide must match the information on your Wise account.

Make sure the photo is not blurry or covered so the company can see all the information. If there is information on the back of the document, they should see that as well.

A valid ID can be:

- Passport (photo page only)

- National ID card

- Driver’s license with photo (except New Zealanders sending NZD).

Valid proof of address can be:

- Utility bills: gas, electricity, or landline phone (cell phone bills are not accepted)

- Bank or credit card statement (photo/scan of the letter or PDF of the statement)

- A council tax bill or HMRC notice

- Vehicle registration or tax

- Photo of driver’s license with address and expiration date, or any other document issued by a government or financial institution

How does verification by ID + selfies work?

In some cases, you may be asked to take a photo of your ID card and selfies to help with verification. In some special cases, you may be asked to upload your photo (selfie) while holding your ID card.

How long does verification take?

If the company asks to verify you when you make the transfer, they will start checking your documents as soon as they receive the money for the transfer. After that, the company will try to do it all within 2-3 business days. After successful verification, the company will automatically resume the transfer and notify you by e-mail.

Note that some countries have specific requirements. If your business is registered in the US, Singapore, Japan, Hong Kong, or New Zealand, the company may require additional information before it will verify your account.

It only supports charities registered in Canada, the EEA (European Economic Area), Switzerland, the UK, the USA, Australia, and New Zealand.

It also only supports trusts in Canada, the EEA (European Economic Area), Switzerland, Australia, New Zealand, and the UK.

What are the benefits of having a business account with Wise?

- Have 50+ currencies in your account

- Instantly convert currencies in your account with low fees

- Get account details to receive money in AUD, CAD, GBP, HUF, EUR, NZD, RON, SGD, TRY, and USD

- Set up direct debit in AUD, CAD, GBP, EUR, and USD

- Order the Wise card (currently available in Europe, the US, Australia, New Zealand, Japan, and Singapore)

- Spend money from your debit card in any currency with low fees

- Set aside money in any currency with Wise Jars.

Yours, Amaz.Markets