Do you know the easiest way to open a US bank account? Most people prefer to go to inpatient institutions, whose opening process is bureaucratic and taxing. A much easier way to do all this is to open a U.S. account with Mercury, which is geared toward America-focused businesses.

You can apply for a business bank account entirely online and get a response from Mercury in just a few days. Moreover, to make it even easier for you and to help you gather all the necessary paperwork, we’ll go over the Mercury application process, detailing all the forms that will help you prove your eligibility for a business bank account.

How to open a US bank account? Mercury sign up

First, before you apply to open a bank account with Mercury Bank, it is important to understand that your company is incorporated in the United States and has an EIN (Employer Identification Number). This is a necessary step to open any business bank account in America.

So the first thing to do is to register your company in the United States.

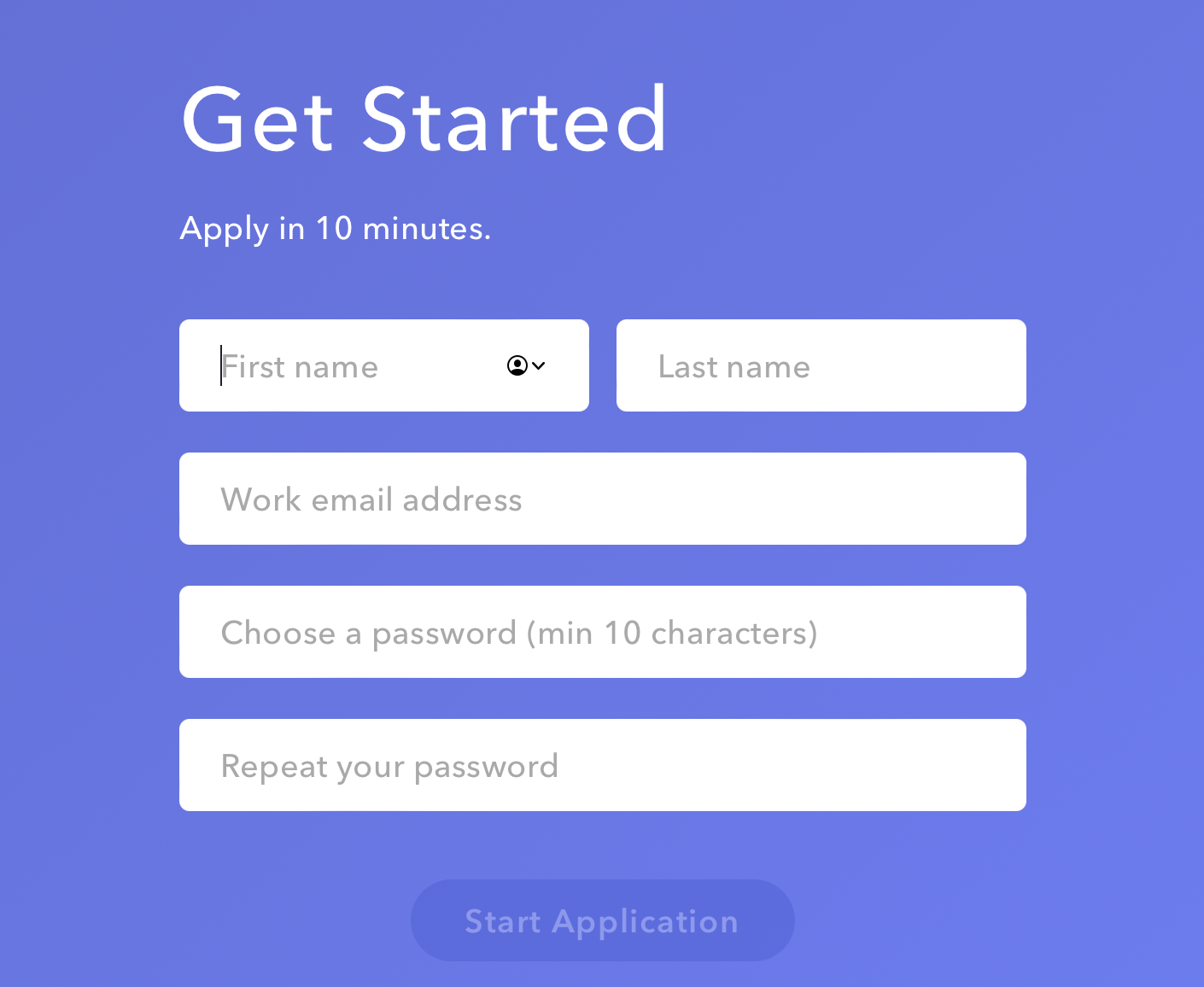

Step 1: Start applying

Once you have registered your company, you are ready to begin the application process.

The first information you need to enter is your full name and corporate email address. Then choose a password.

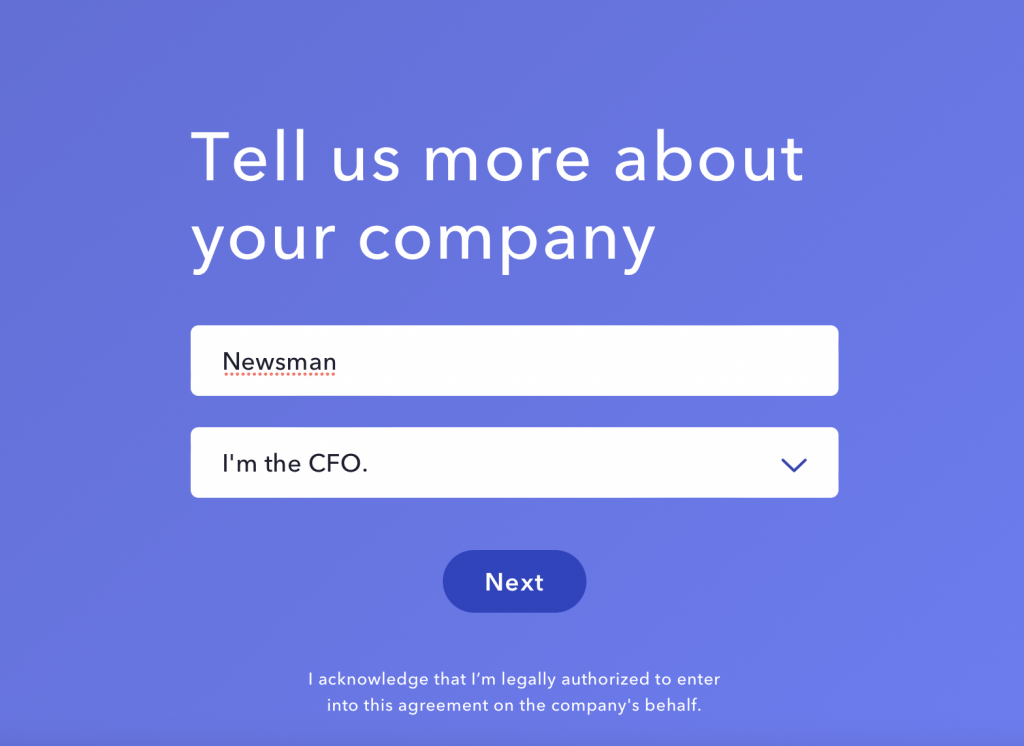

Step 2: Company details

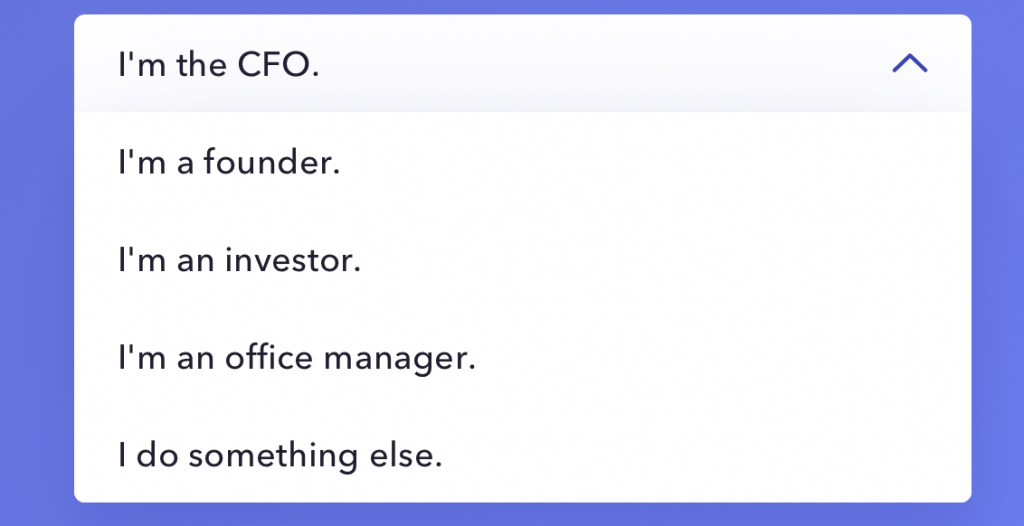

Meanwhile, after filling out the basic information to open an account, you need to go into the details of your company, specifying the name of your organization and your role in the business. You can choose one of the roles listed below:

- The CFO

- A founder

- An investor

- An office manager

- I do something else

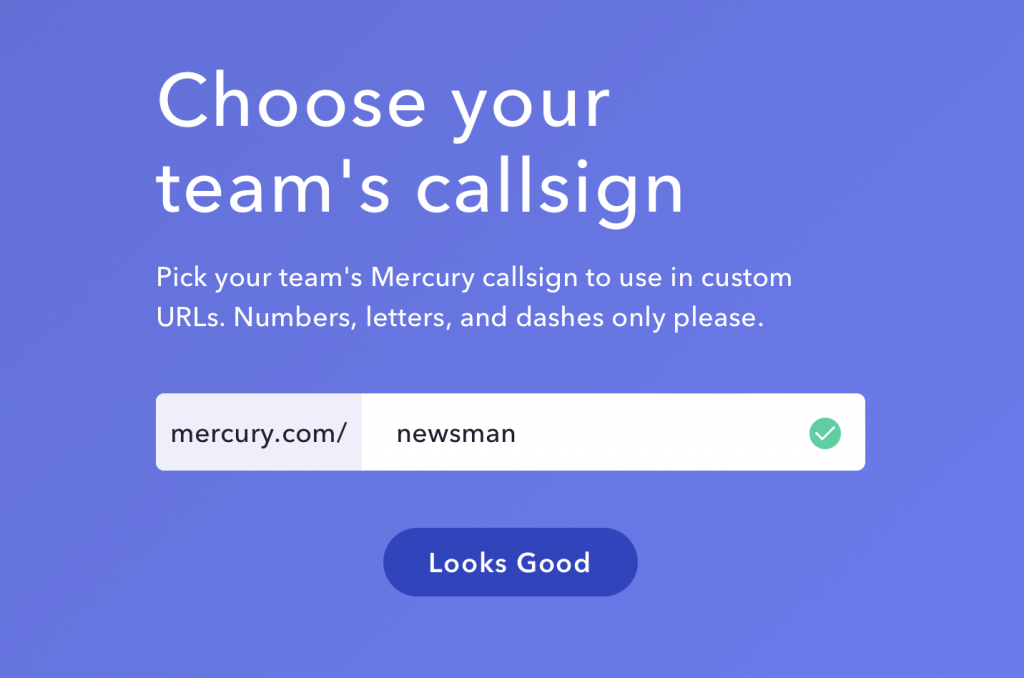

Step 3: Create a unique callsign for your team

This callsign will be used as the user URL.

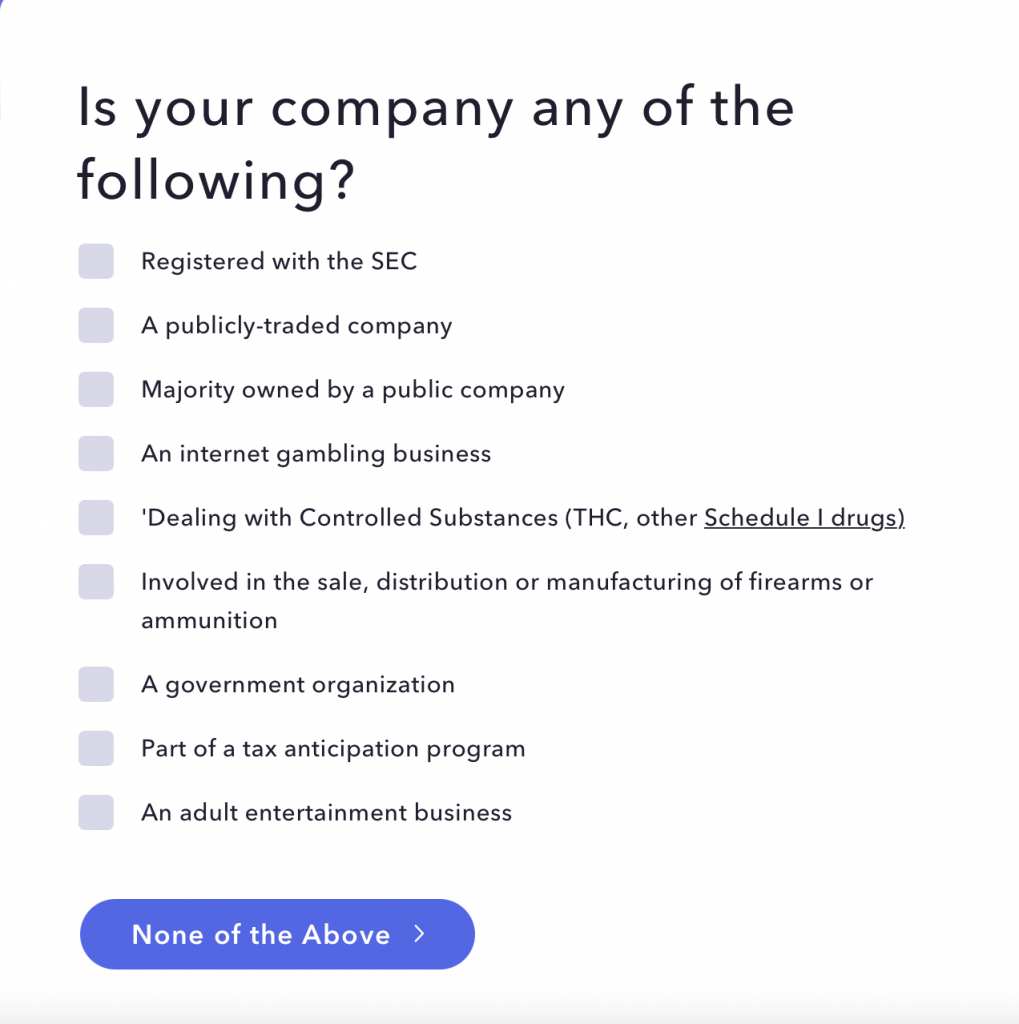

Step 4: Choose the best option that describes your type of business

Mercury only accepts accounts if your company is one of the following:

- Registered with the SEC

- A publicly-traded company

- The majority is owned by a public company

In the meantime, other business options involving monetary services and those involving adult entertainment, marijuana, or Mercury don’t accept internet gambling because of inconsistency with neo-banking services.

Step 5: Start creating your company profile

This is the longest and most important part of your application, where you will have to provide some legal information about your business and team.

Meanwhile, you can start filling out any order, and if you want to finish the profile later, there is an option to save your progress at any time to continue at another time.

Your corporation profile is divided into seven sections:

- Info

- Contacts

- Owner profiles

- Company names

- Formation documents

- EIN verification

- Expected activity

Let’s look at each of these sections separately.

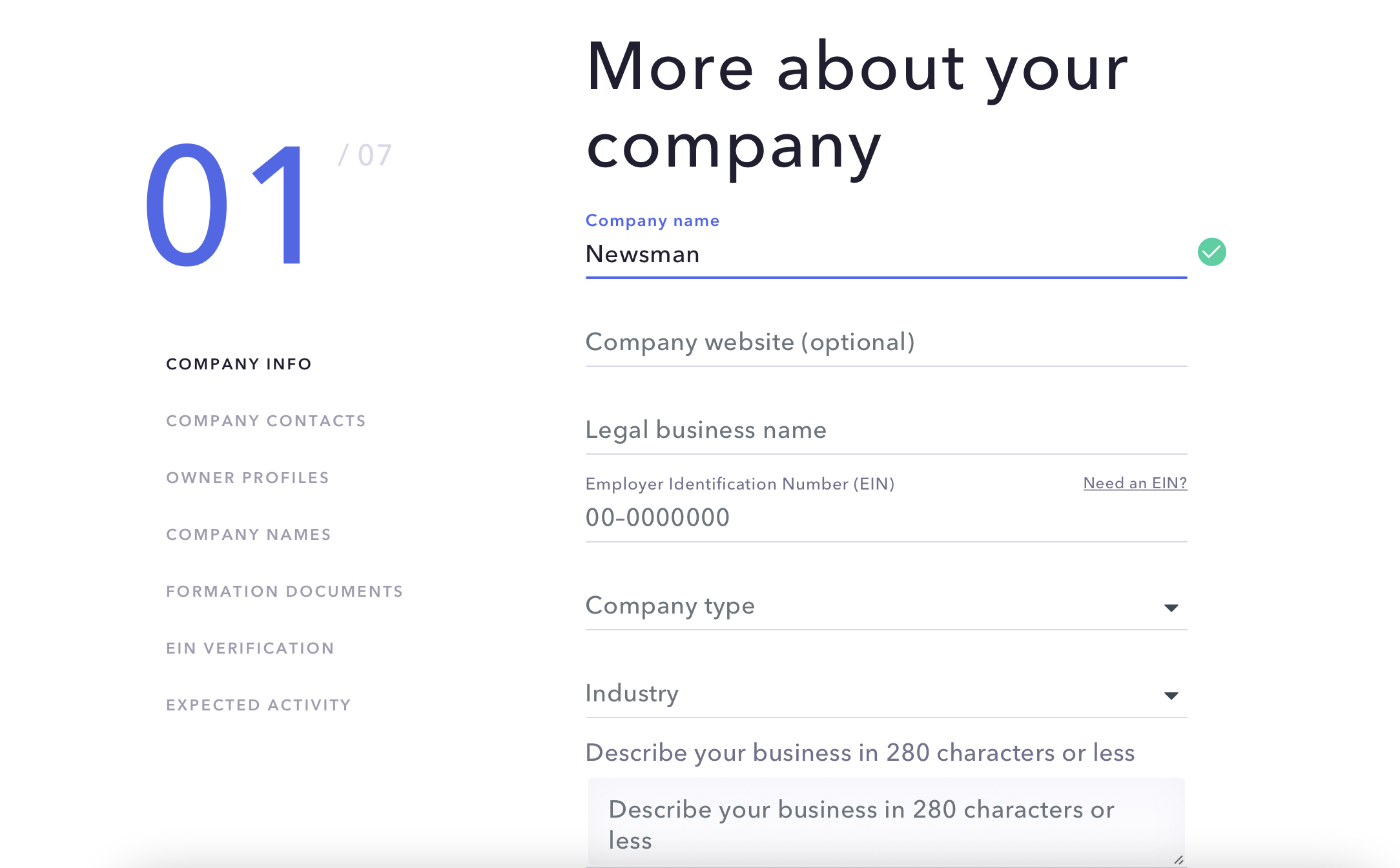

Company info

In this section, you should provide more information about your organization, including your website, legal name, and EIN (Employer Identification Number). You should also describe your business in a few words and indicate the main investors – if any.

To fill out the first section, you must also choose your company type from the choices offered (e.g., C-Corp, LLC, Non-Profit), and the industry your business is focused on.

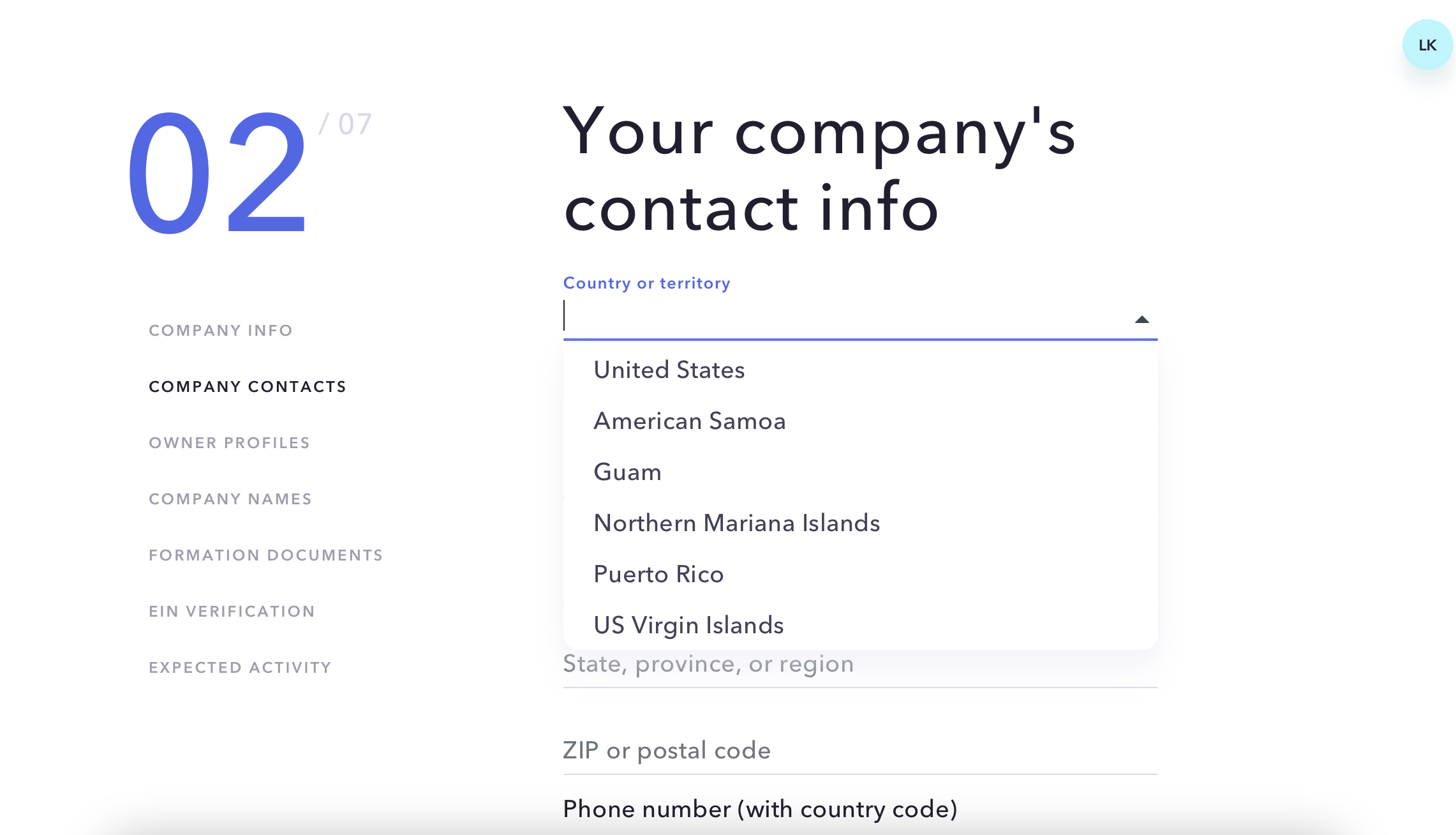

Company contacts

The next step is to specify the location of the company and its contact information: Where is it located? What is the business address? What is the phone number?

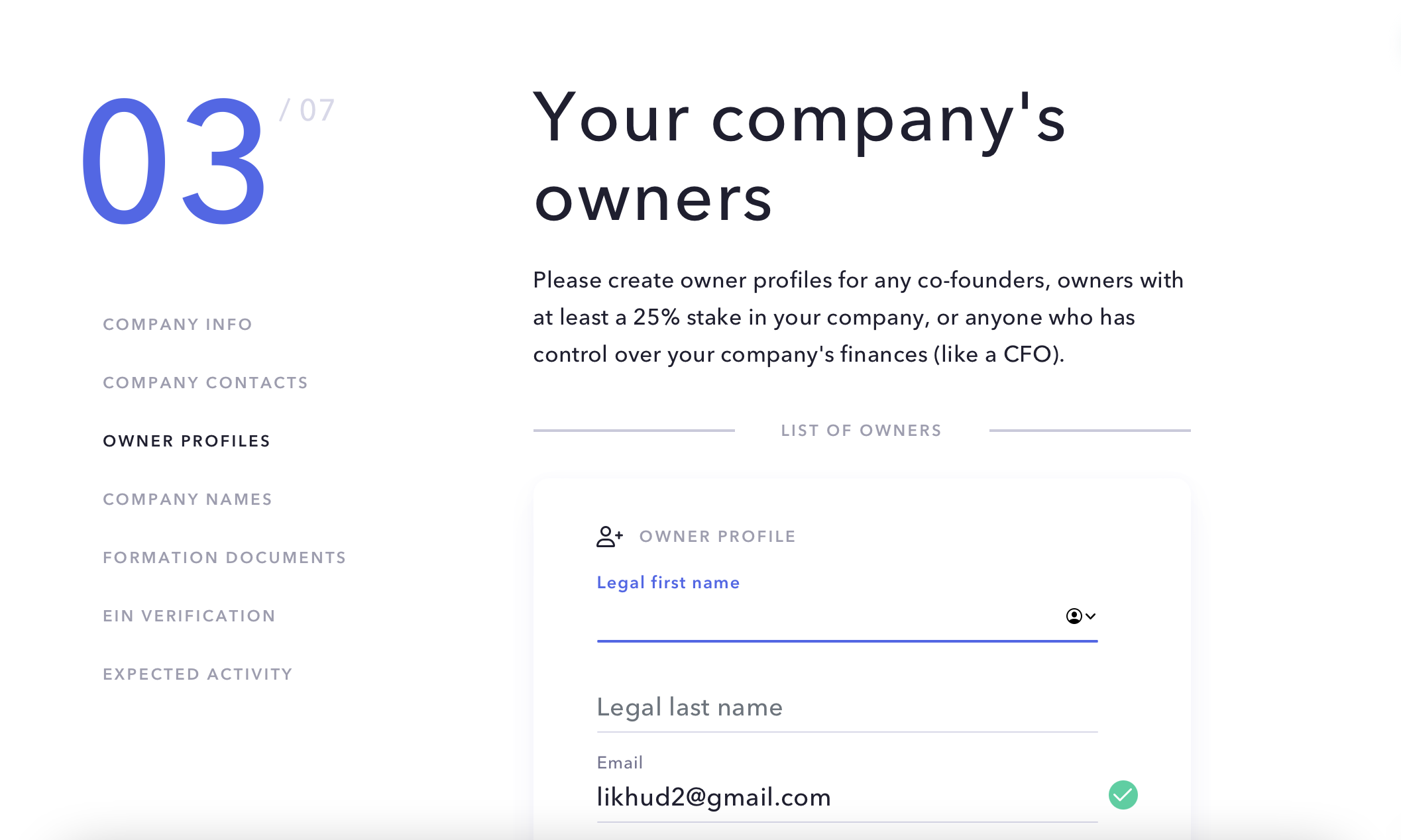

Owner’s profiles

To successfully open a business bank account with Mercury, it is important to include details about the other shareholders, as well as who is responsible for managing the finances (CFO).

You can fill out all the information yourself or you can send them to include their personal information, such as full name, email, title, percentage of ownership, and home address, and provide a photo of their ID card.

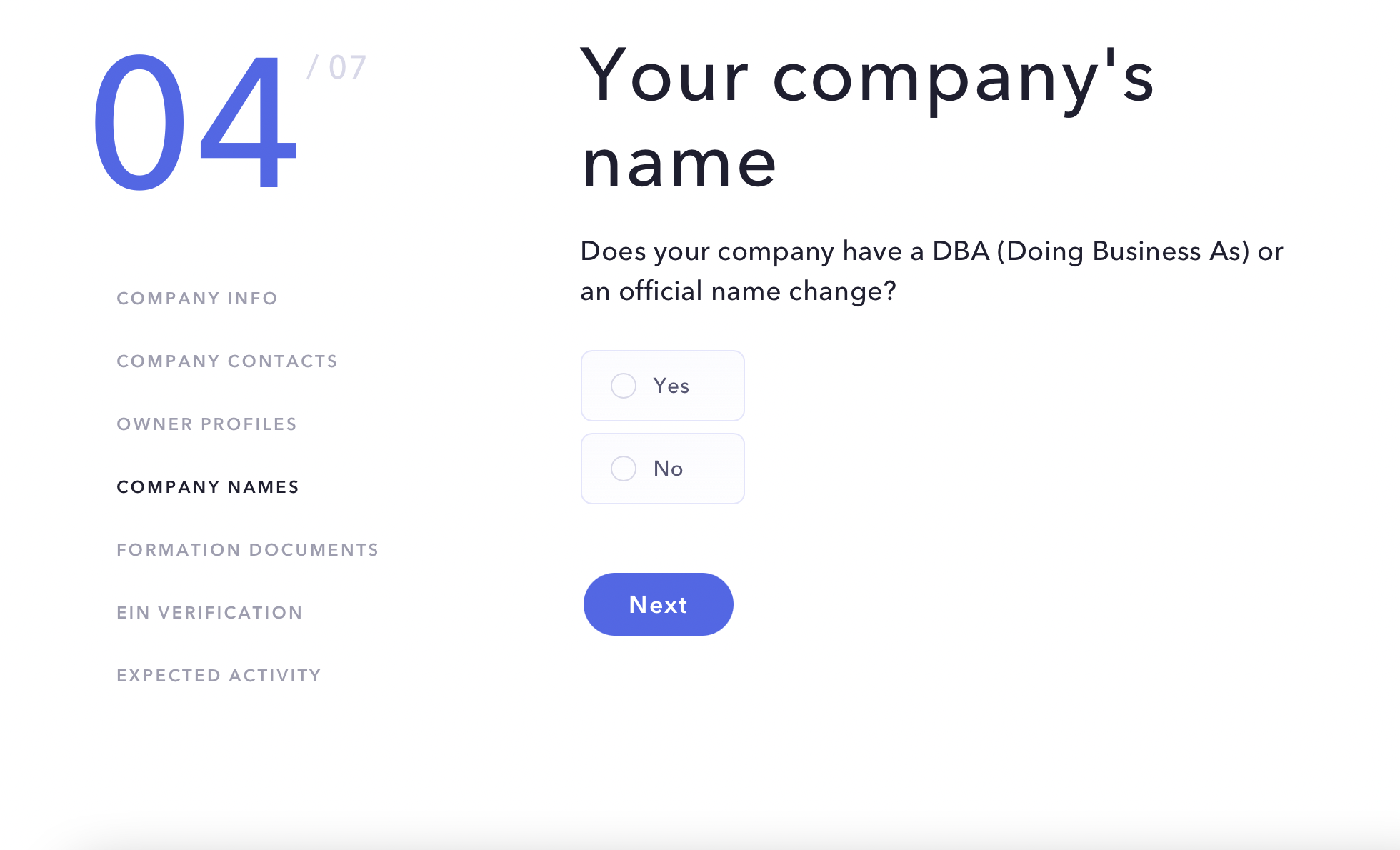

Company names

The fourth step is to find out if your corporation has a DBA (Doing Business As) name, or if the company has officially changed its name.

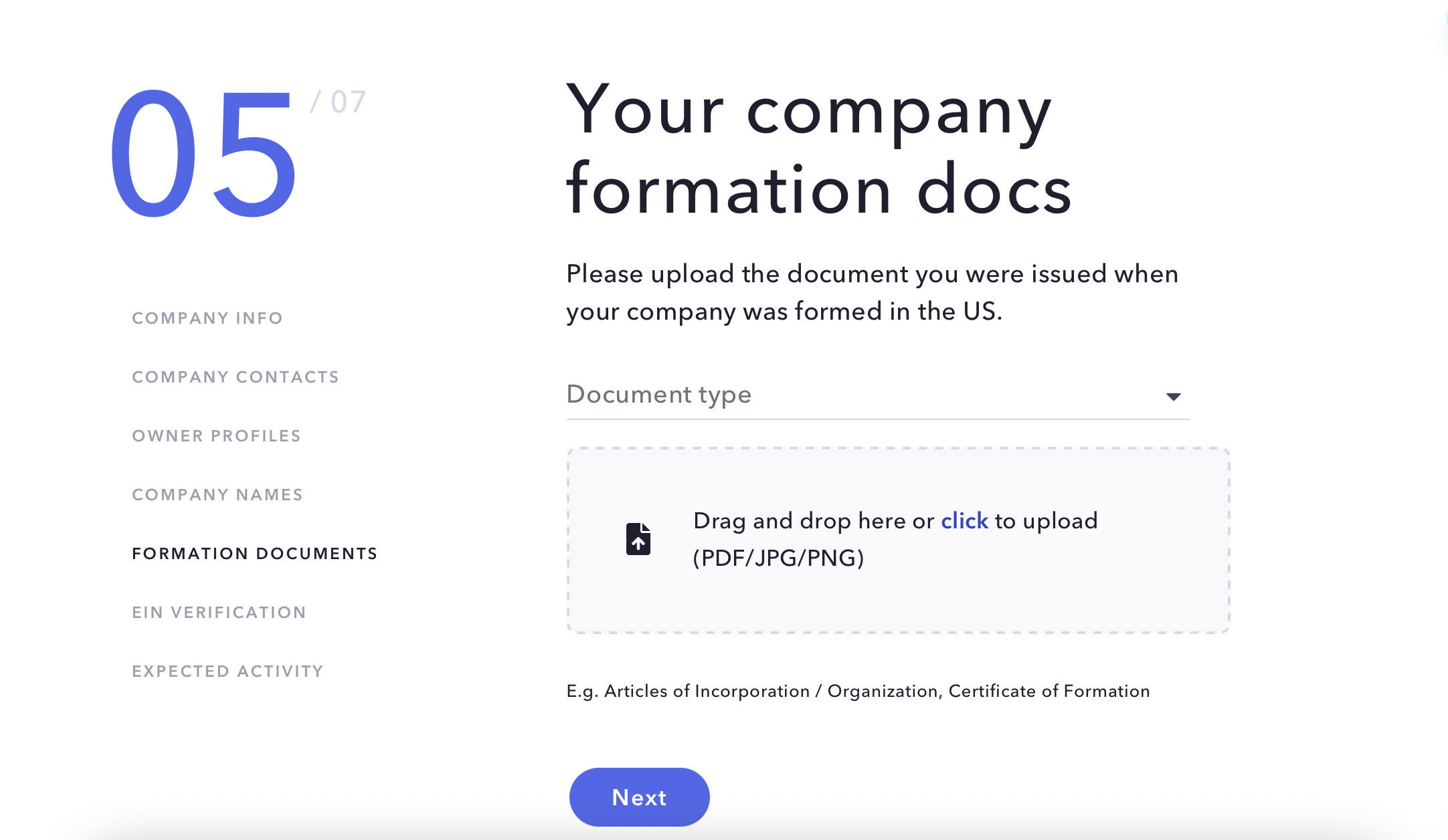

Formation documents

In this part of the application, you must upload all incorporation documents proving that the company was incorporated in the United States.

Articles of Incorporation, certificates of incorporation, or similar documents are sufficient proof that you started a business in the United States.

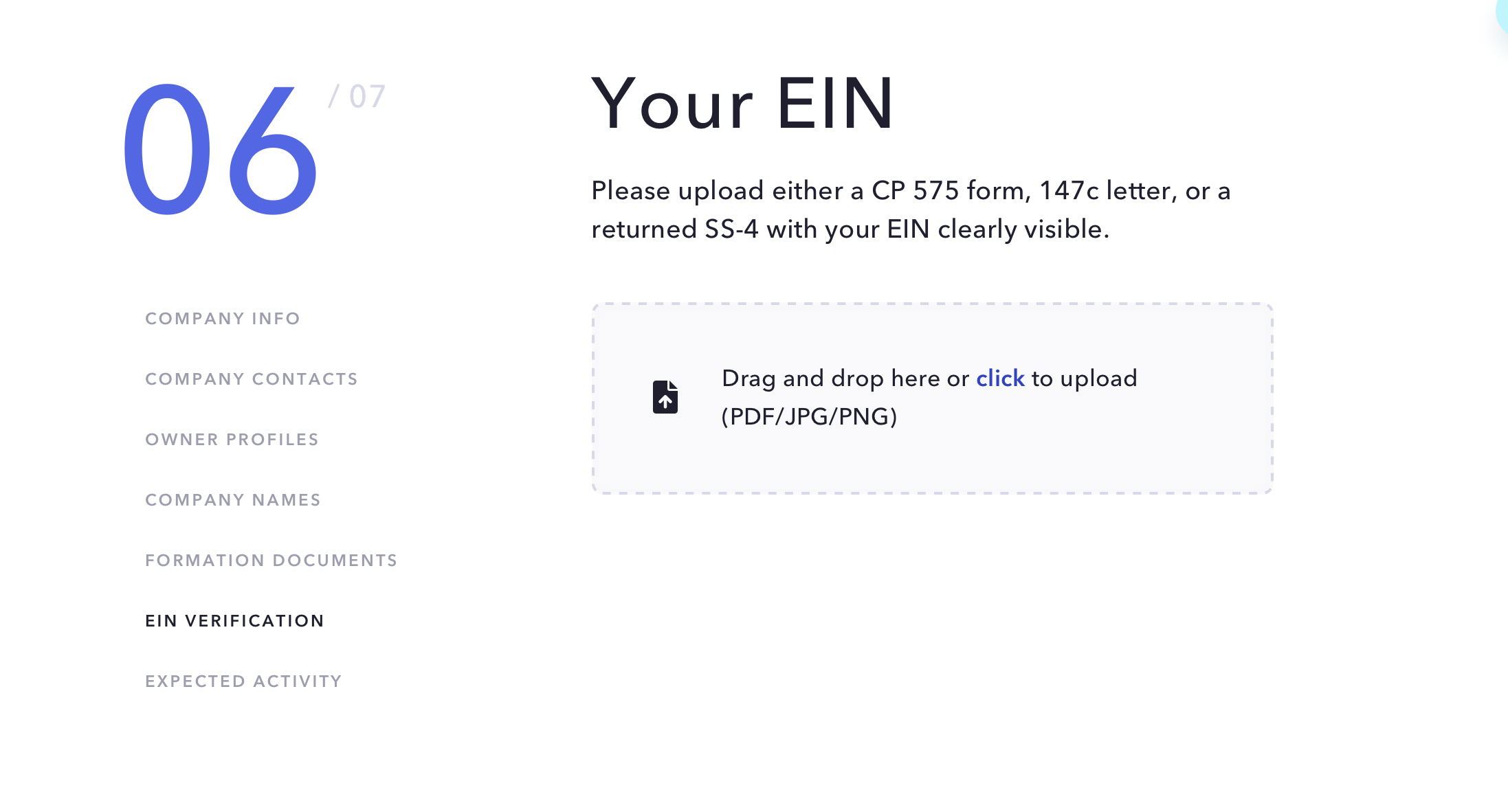

EIN verification

The sixth step is to upload your company’s EIN verification letter.

Mercury accepts as acceptable documents: CP Form 575, a 147c letter, an IRS SS-4 returned, or a screenshot of the IRS website that shows your EIN.

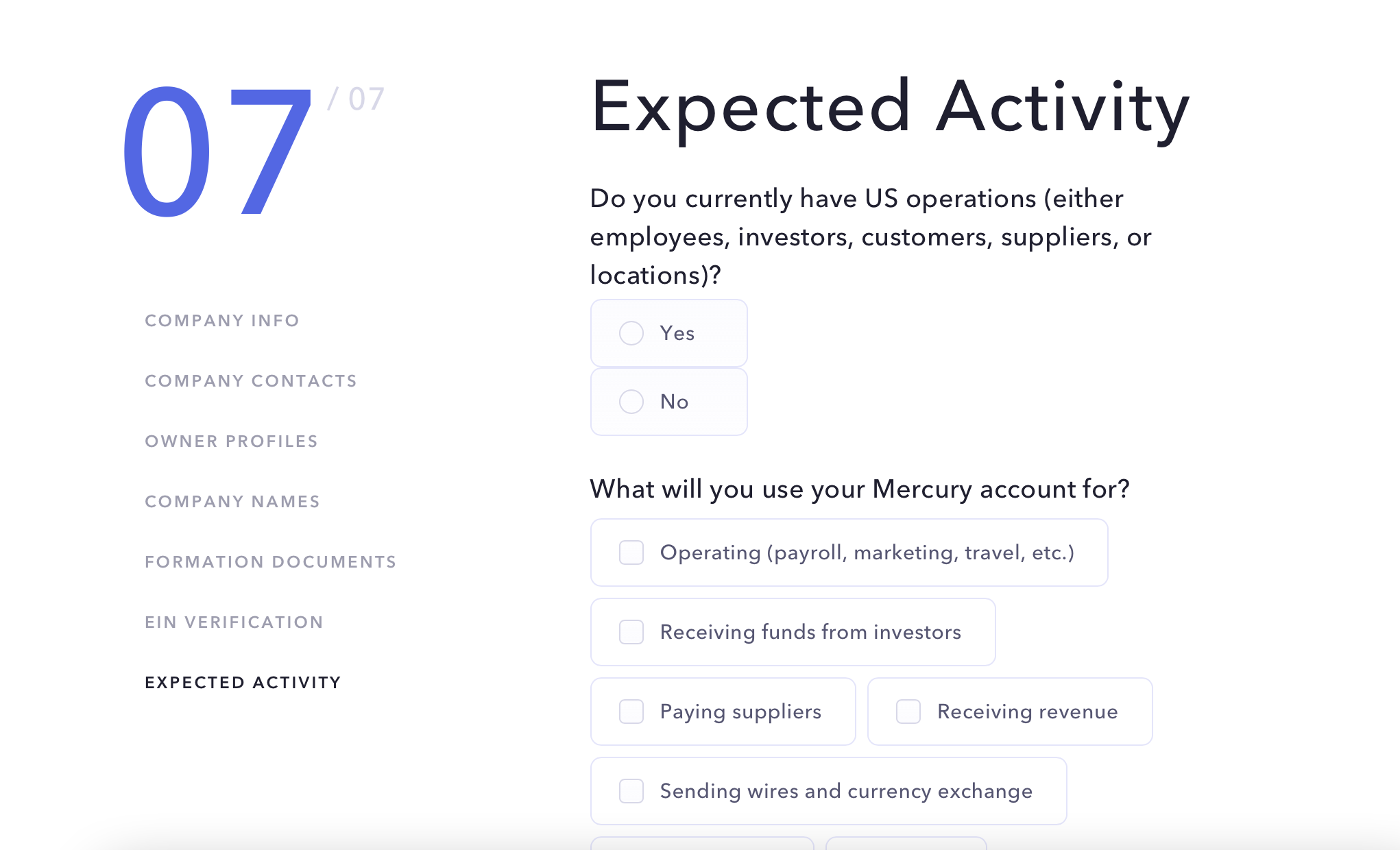

Expected activity

And the last step is to fill in the rest of the necessary information about your company: whether you perform any activities in the U.S. and what you need a Mercury account for.

Once you complete all seven steps, you can review the final application, agree to the legal terms, and submit your company profile for review.

Please note that while there is optional information, the more information you provide, the easier it will be to get your application accepted by Mercury.

Transparent answers to all questions will give you a better chance of getting started with your new business bank account.

0